About Us / Our Impact

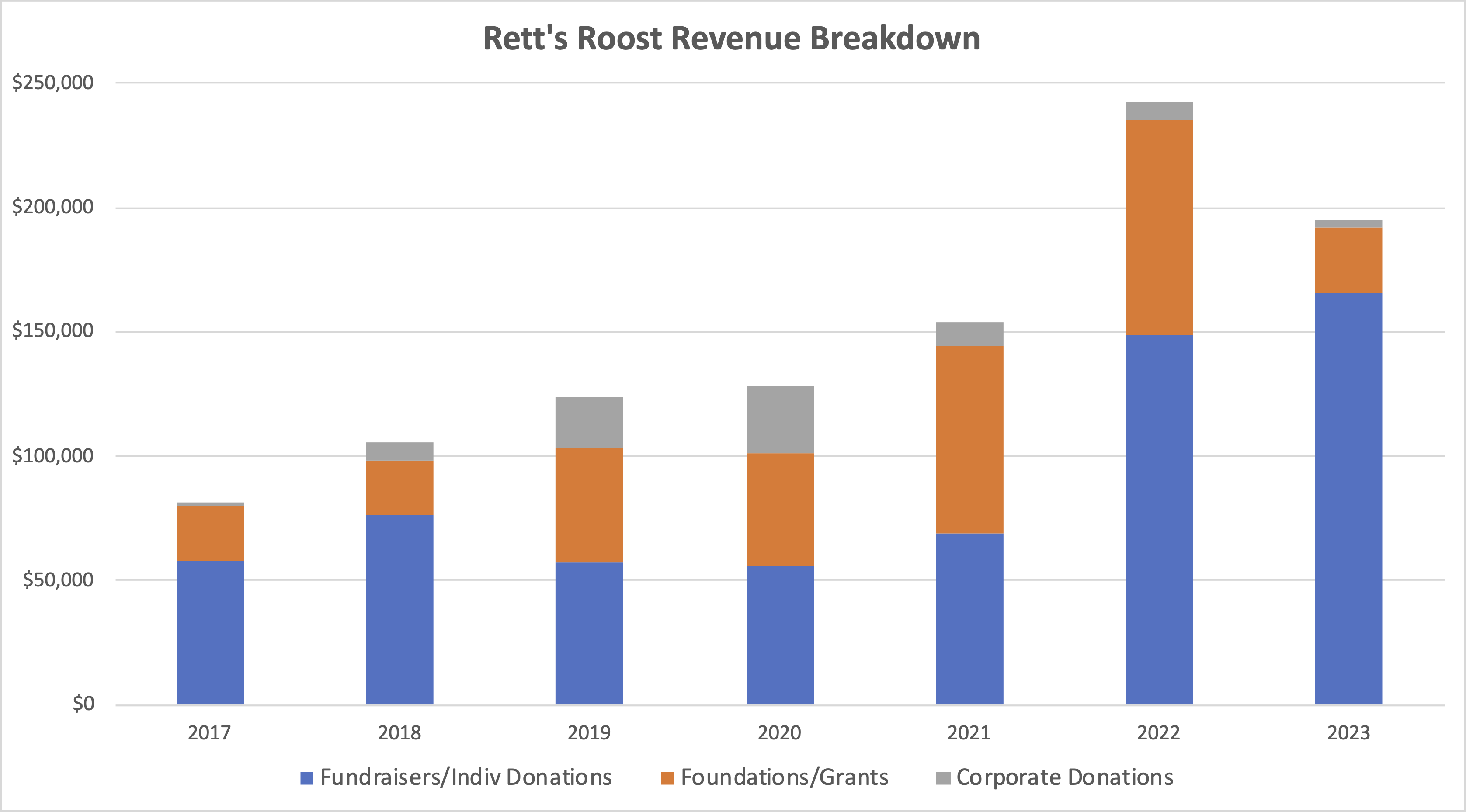

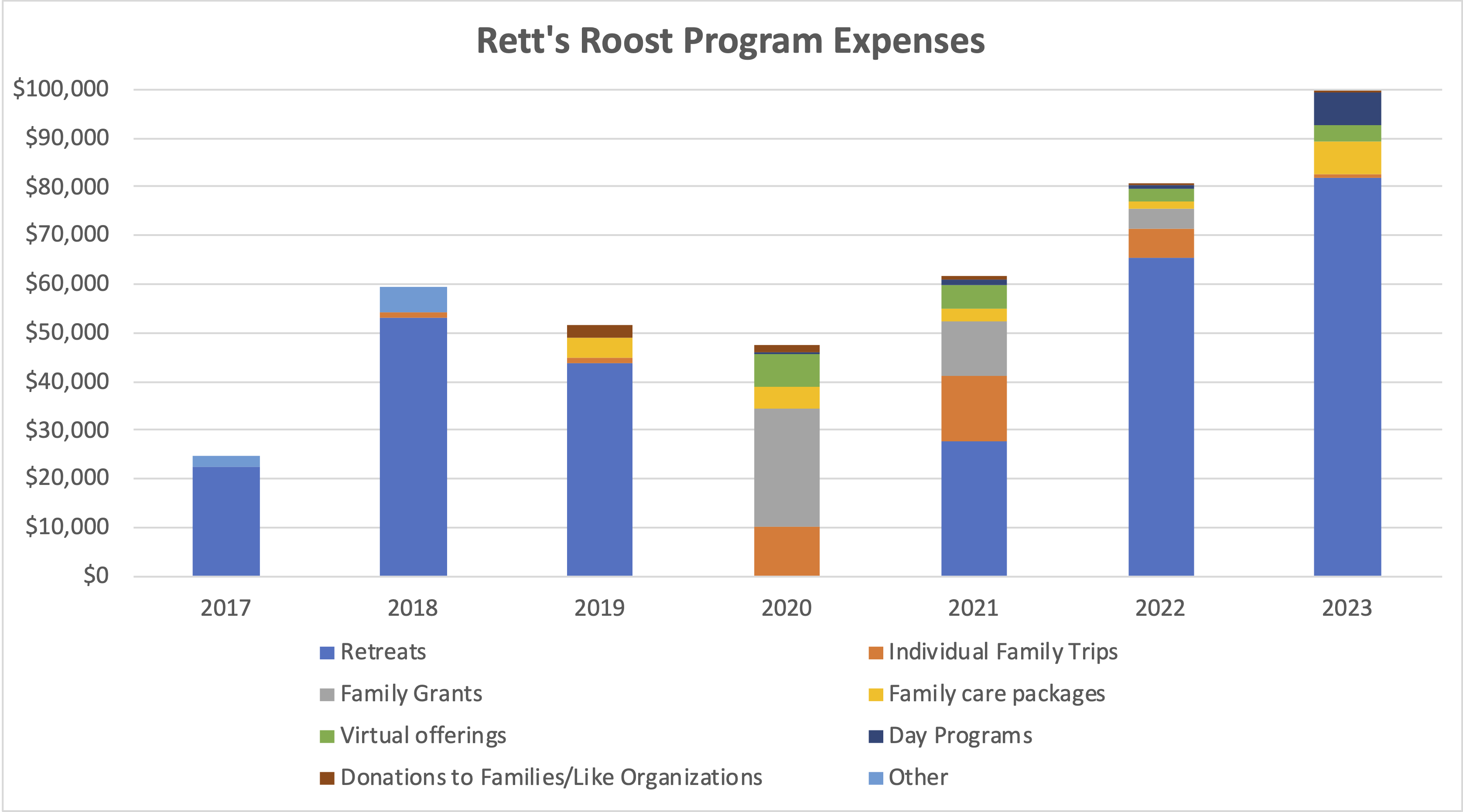

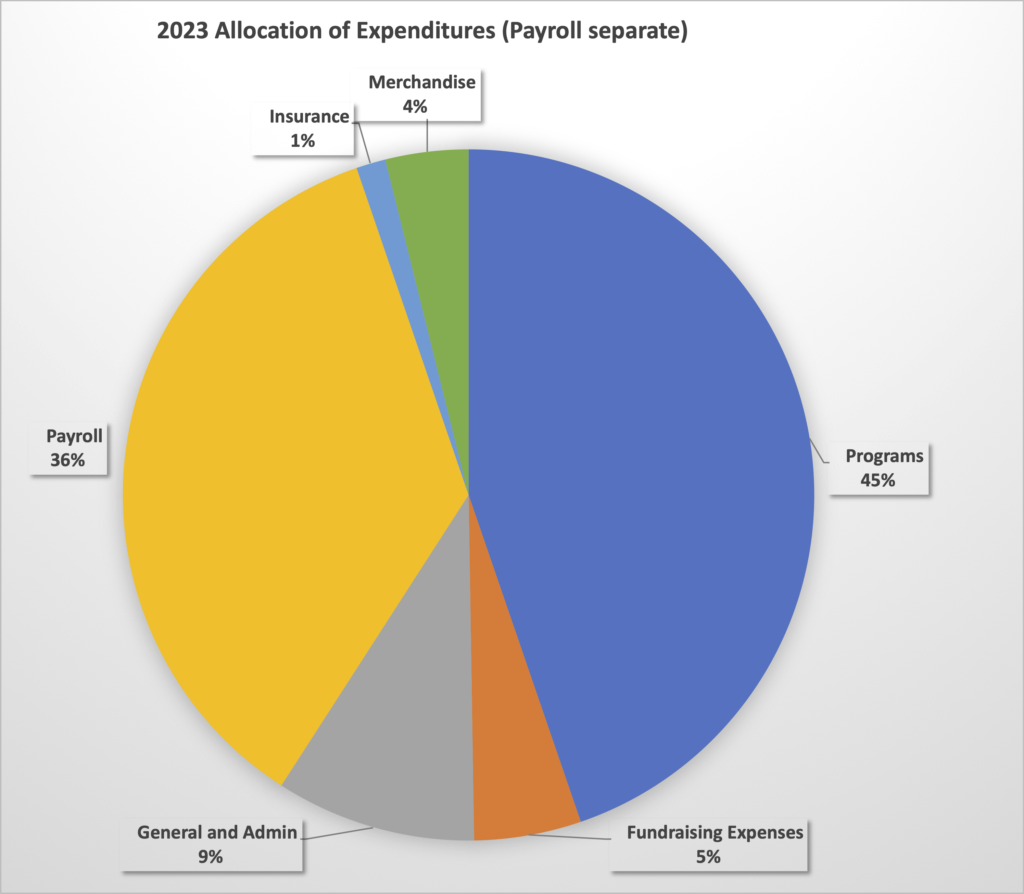

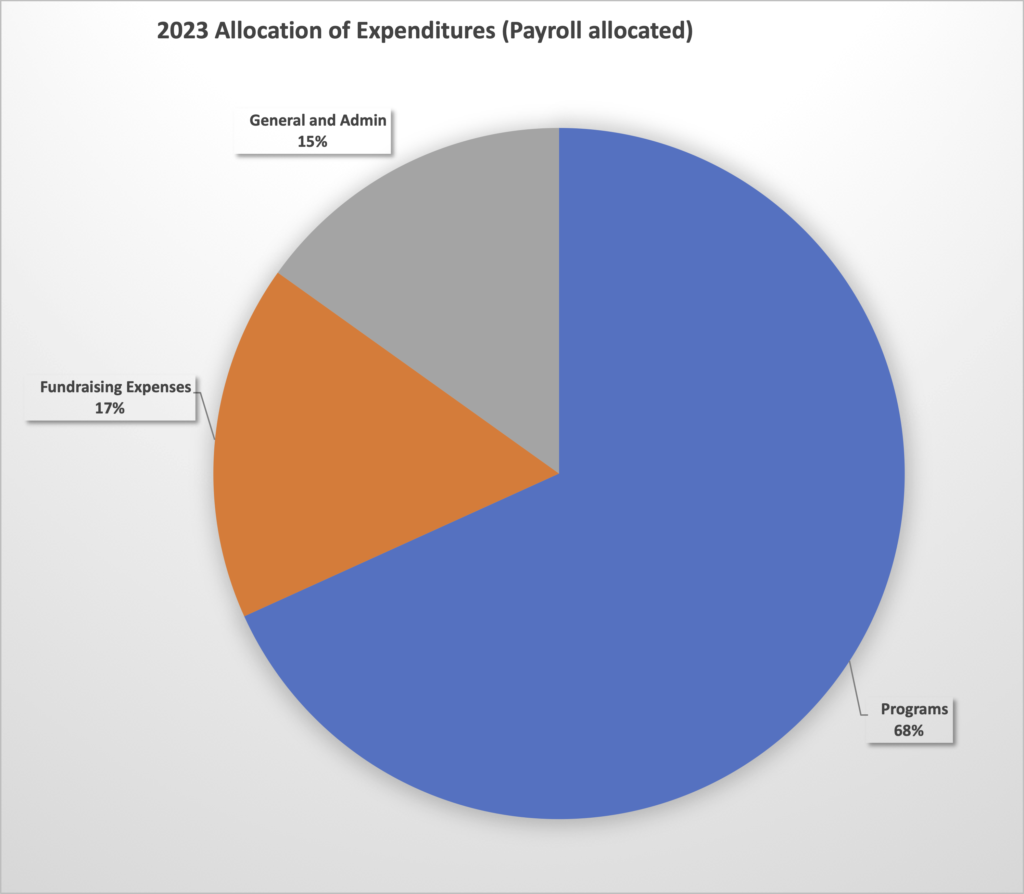

Financials

Rett’s Roost is a recognized 501(c)3 organization in good standing with all state and federal entities. We aim for complete transparency and fiscal responsibility.

Guidestar/Candid Recognition

Rett’s Roost has achieved the level of Platinum Transparency according to Candid / Guidestar. Visit our Guidestar profile to access relevant organizational information and pertinent reporting by clicking on the seal below.

Statement of Financial Position

Download the report below to compare financial data from 2023 and 2024.

Financials 2024-2025Annual 990 Tax Exempt IRS Reporting

The 990 is the tax form the Internal Revenue Service (IRS) requires all 501(c)(3) tax-exempt charitable and nonprofit organizations to submit annually. The Form 990 is designed to increase financial transparency and includes revenue, expenditure, and income data in addition to information used to assess whether a nonprofit aligns with federal requirements for tax-exempt status. The forms are publicly accessible.

Financial Charts